Polkadot is one of the newest blockchain projects. This blockchain is different from other traditional cryptos. Bitcoin, Litecoin, Dogecoin all reside in their isolated crypto network. Polkadot’s main objective is to provide a network backbone for these blockchains to intercommunicate with each other.

Polkadot is a promising project. However, if we deep dive into this blockchain, we would see Polkadot is destined to fail. In this article, we would explain why Polkadot will ultimately fail.

The best place to learn all about Polkadot is the official wiki page: https://wiki.polkadot.network/docs/en/getting-started

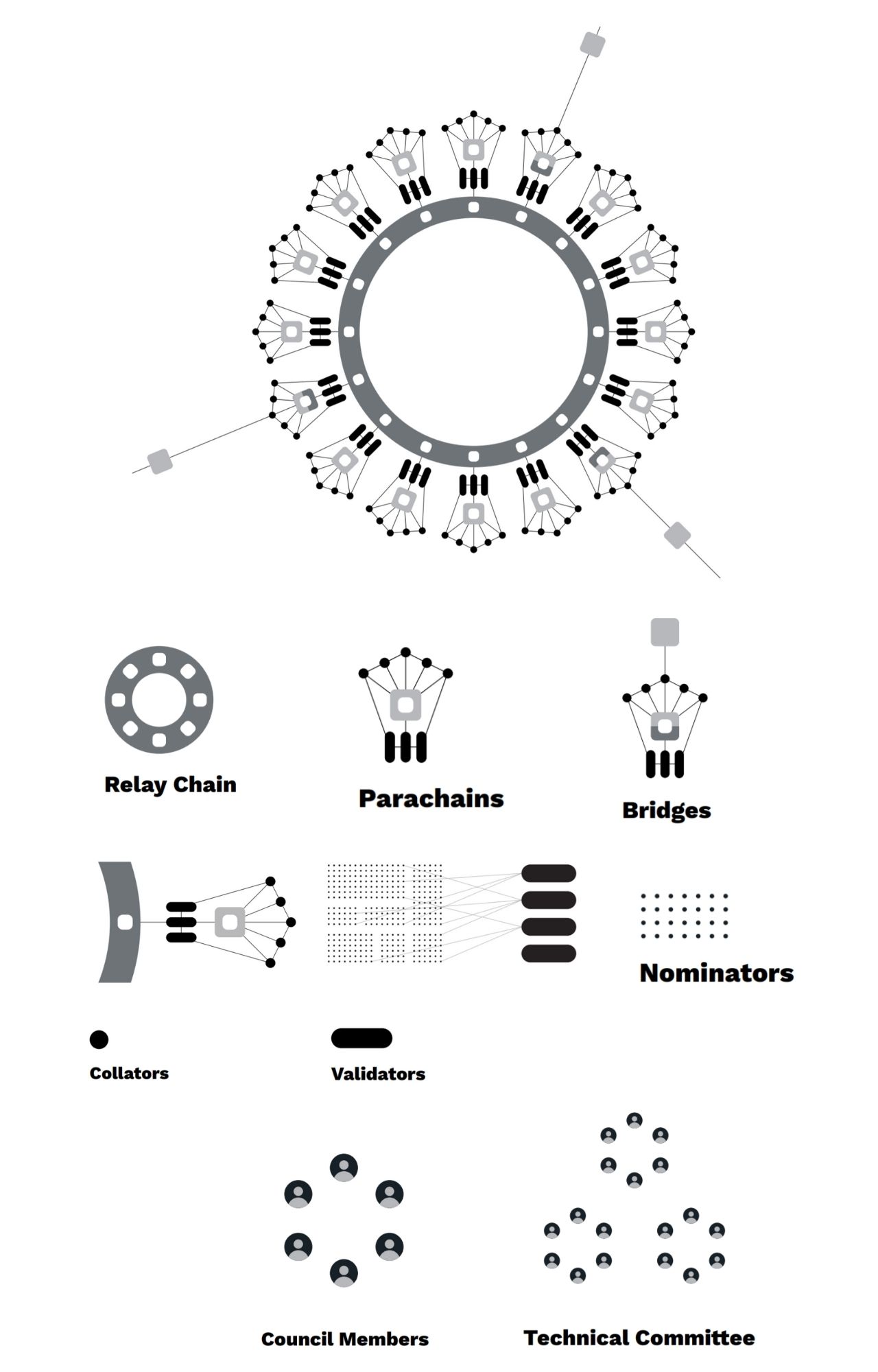

First of all, we would explain the architecture of this network, so it will be easy to understand the pitfalls of Polkadot.

Relay Chain:

The Relay Chain is the backbone of the Polkadot network. Everything happens here. Other blockchains and cryptocurrencies will connect to this Relay Chain.

Parachains:

Parachains are independent blockchains that are always connected to the Relay Chain. These Parachains must be created through a template known as “substrate” provided by Parity Technologies, the creator of Polkadot blockchain.

Parathreads:

Parathreads are the same as Parachains. The only difference is that they are not always connected to the Relay Chain. They connect to the Relay Chain when it’s necessary.

Bridges:

As we can see that only those blockchains that are made using substrate can directly connect to Polkadot’s Relay Chain. Bitcoin, Litecoin, Ethereum, or others are not created using the substrate. Therefore, they need special Parachains that will allow them to connect to Relay Chains. These are known as Bridges.

Validators:

Powerful computers that maintain the security and process the Polkadot’s transactions are known as Validators. In other blockchain networks, we call them miners.

Collators:

Every Parachain and Parathread sometimes needs their miners who will process all the transactions. They are known as collators.

Council Members:

Council members govern the Polkadot network. Every change must go through them. They are the gatekeeper of this network.

Technical Committee:

The Technical Committee decides and applies all the technical and programmatic changes to the Polkadot.

DOT:

DOT is the currency of the Polkadot network. Please visit https://coinmarketcap.com/currencies/polkadot-new/ for the latest price of the DOT.

Treasury:

All the newly created coins are gathered under the treasury account. From there, all DOTs are dispersed.

Now let’s examine why Polkadot will fail.

Everything in the Polkadot revolves around the DOT (Polkadot currency). In this network, money talks. You have DOT; you have power. You don’t have DOT; there’s nothing for you in this network.

It’s Tough To Become Validators:

If you want to mine Bitcoin, Litecoin, Bitcoin Cash, or other cryptocurrencies, all you need a powerful computer and internet connection. If your computer is powerful enough to process transactions, you will get rewarded from the Bitcoin, Litecoin, etc., network (simplified explanation). Furthermore, there’s no limitation on how many miners can join these blockchain networks: the more, the better for security. Not valid for Polkadot.

Note: As of writing this article, Polkadot allowed only 297 validators. This number would rise to 1000 overtime.

On the Polkadot, there will be a maximum of 1000 validators. So, there’s a limited number of slots for miners. Moreover, those who want to be a validator must enter a competition to put the maximum amount of DOT (money) bond for 28 days. It’s called staking. 1000 contestants with the highest DOT bond will be selected to become validators for the Polkadot for 1 day. This process goes on every day.

As of writing this article, the minimum number of DOT required to become a validator is 1.7 million. At $40/DOT, it is $68 million. If DOTs price rises to $100, a validator needs $170 million unless the competition to become a validator drives up the number of minimum DOTs. Besides large companies, no one can put $68 million on the line for 28 days to become a validator. As a result, only a handful of companies will control the whole Polkadot network and become centralized in the future.

It’s Expensive To Become Nominators:

From the previous discussion, we can see that not everyone can become a validator because of the shortage of money. However, DOT holders can help a validator.

There are two types of validators.

- Active validator

- Inactive validator

Those who are actively participating in the Relay Chain are known as Active validators, and those who could not make it because of the shortage of DOT is known as an inactive validator.

During the validator nomination phase, you can ask Polkadot to count your DOT towards a validator, thus helping them get into the active validator set. You can nominate up to 16 validators. In this case, you are referred to as the nominator. If your chosen validator is selected, Polkadot will lock your DOT for 28 days. It’s called staking. You can’t transfer, withdraw, or send your crypto for these days. Because you are staking your DOT, you would get a reward in DOTs from the validator according to their terms and conditions.

There are several problems with the above process.

- According to the Polkadot network rule, a maximum of 128 nominators is eligible for staking reward from a validator. If a validator has 130 nominators, only 128 nominators with the highest DOT stake will get rewarded. Rest will receive nothing.

- Because of the above economics, you need a minimum of 180 DOT (rising every day). At $40/DOT, you need $7200 if you want to get a stake reward. Please visit https://polkaview.network/dot to know about the latest minimum DOT required to earn rewards.

- If a validator decides not to reward (keeps 100% commission), you are out of luck, and you receive nothing.

Unequal Reward-Punishment Ratio:

The validators and nominators are staking their own money on the line to keep the Polkadot Relay Chain secure and operational. However, if a validator misbehaves, stays offline, their staked DOT will get slashed by the network.

When Polkadot rewards a validator, it comes in numbers. For example, it may be 1,000 DOT. However, the slashing comes in the form of a percentage, for example, 0.1% — a 0.01% of 2 million DOTs equal to 2000. Furthermore, the slashing is arbitrary and ultimately depends on council members. So, it could be higher and sometimes up to 100%.

Moreover, we know that only 128 nominators of a validator receive rewards. But during penalty slashing, every nominator’s DOTs get slashed. Therefore, if a validator has 150 nominators, 128 would receive dividends, but all 150 nominators DOT would get slashed during network penalty.

Only Rich Can Become Council Members:

Polkadot currently has 13 council members. The maximum number of council members would be 24. These members are elected through the power of DOT. In simple terms, 1 DOT means 1 Vote.

Here is the list of the latest council members: https://polkadot.js.org/apps/#/council

As of writing this article, to become a Polkadot council member, one needs a minimum of 11 million DOT backing. At $40/DOT, it’s $440 million. Unless you are a world-class celebrity or super-rich, there’s no way you can become a Polkadot council member. It’s an elite class that controls the fate of Polkadot, and you will never be able to become a council member. Polkadot’s governance has become a plutocracy.

Risk Of Proposal:

Polkadot claims that anyone can propose anything for the Polkadot network. If it passes with a majority council member vote, the technical committee will implement it unless it’s detrimental or harmful for Polkadot. However, there are several problems.

- Anyone who wants to submit a proposal must put a few hundred DOTs as a bond. Others can join in to vote with their DOT. If the proposal fails to pass, the treasury will confiscate all the DOTs who voted “Yes.” It’s nothing but poll tax. A long time ago, we amended our US constitution to declare that no one needs to pay to vote. However, Polkadot is bringing it back.

- Even if your proposal gets the majority vote, any council member can veto it. Thus, killing your proposal, and you will lose all of your staked DOT.

- After it passes the council committee, it will go to the technical committee. If the technical committee thinks your proposal is harmful to the Polkadot, they can cancel it. Thus, the treasury will confiscate your DOT.

Therefore, Polkadot is not a democratic blockchain. Monetary punishment intimidates general DOT holders to propose any changes to the Polkadot network.

Technical Committee:

The technical committee has 2 members — Web3 Foundation and Parity Technologies. They are the creator of Polkadot. Therefore, Polkadot is not an open, decentralized blockchain; it’s a centralized blockchain controlled by one entity.

Web3 Foundation and Parity Technologies are not a different entity; they are a single entity run by Gavin Wood, the creator of Web3 Foundation and Parity Technologies. Gavin Wood is also a permanent council member. Therefore, he basically controls the whole Polkadot network.

Limited Slot For Parachain:

The Relay Chain will have a maximum of 100 slots for Parachain. It is constrained by design to create a fake scarcity. Out of 100, few are reserved for Parathreads and other dedicated Bridges (Bitcoin). Therefore, Polkadot can’t connect all the blockchain projects out there into one network.

Moreover, to access the Polkadot network, Parachain, Parathread, and Bridges have to put a considerable amount of DOTs as a bond. How is this business model sustainable?

Insane Inflation:

Everyone wants to invest money. After all, we know fiat currency loses value because our government prints money every year. Everyone criticizes the US treasury for inflation. Here is the USD inflation rate.

| Year | USD inflation rate |

|---|---|

| 2021 | 2.24% |

| 2020 | 0.62% |

| 2019 | 1.81% |

| 2018 | 2.44% |

| 2017 | 2.14% |

| 2016 | 1.26% |

| 2015 | 0.12% |

| 2014 | 1.62% |

| 2013 | 1.47% |

| 2012 | 2.07% |

| 2011 | 3.14% |

| 2010 | 1.64% |

Source: https://www.statista.com/statistics/244983/projected-inflation-rate-in-the-united-states/

As you can see, USD inflation fluctuates from 1% to 3%. Do you know Polkadot’s inflation rate?

Polkadot does not have a fixed inflation rate, but it varies between 8% to 10%. It’s insane. It has several negative severe implications.

- We know that a validator can give rewards to a maximum of 128 nominators. There will be a maximum of 1000 validators. Therefore, 128,000 people are eligible in the whole world to receive staking rewards. Others will receive nothing. So, all other DOT holders would lose value due to inflation.

- AParachain has to put DOT as a bond for 2 years on 6 months increment. It means they would lose 16% to 20% of DOT’s monetary value due to inflation.

DOT Concentration:

As there is a roadblock (minimum staking requirement and maximum 128,000 nominators) for general people to stake DOT, most DOT holders flock to Kraken and other crypto exchanges. These exchanges collect DOTs and stakes collectively. Thus, it creates a power concentration. Therefore, Polkadot, instead of becoming decentralized, has become a centralized blockchain.

Conclusion:

The whole Plkadot ecosystem revolves around money. Those who have more money (DOT) control everything in this blockchain. Ultimately it will be the downfall for this crypto.