Bitcoin is the most popular cryptocurrency in the world. It’s the first implementation of blockchain for digital cryptocurrency.

Some cryptocurrencies are backed by the US dollar, such as Tether (USDT). There are altcoins that are backed by Gold, such as Digix Gold Token (DGX).

However, Bitcoin is neither backed by Gold nor by US dollars. Bitcoin’s value entirely comes from perceived rarity, supply, and demands. It has value because people believe it has value.

Up until 1971, the US dollar was backed by Gold. However, on August 15, 1971, the US government abandoned the Gold standards. Before this, the US government was required to buy 1 ounce of Gold to print $35 paper dollars. However, after the abandonment of Gold standards, the US treasury can print as much money they want without any limitations or repercussion.

Therefore both USD and Bitcoin are not backed by Gold, Silver, or anything. However, Bitcoin has some superior features to the US dollar. Let’s explain.

The US government’s total yearly budget now regularly exceeds $4 trillion. However, our government hardly takes in $3.5 trillion in taxes ( income tax, social security tax, medicare and Medicaid tax, and others). Due to this budget shortage, the US government prints money every fiscal year. (Source: Reuters)

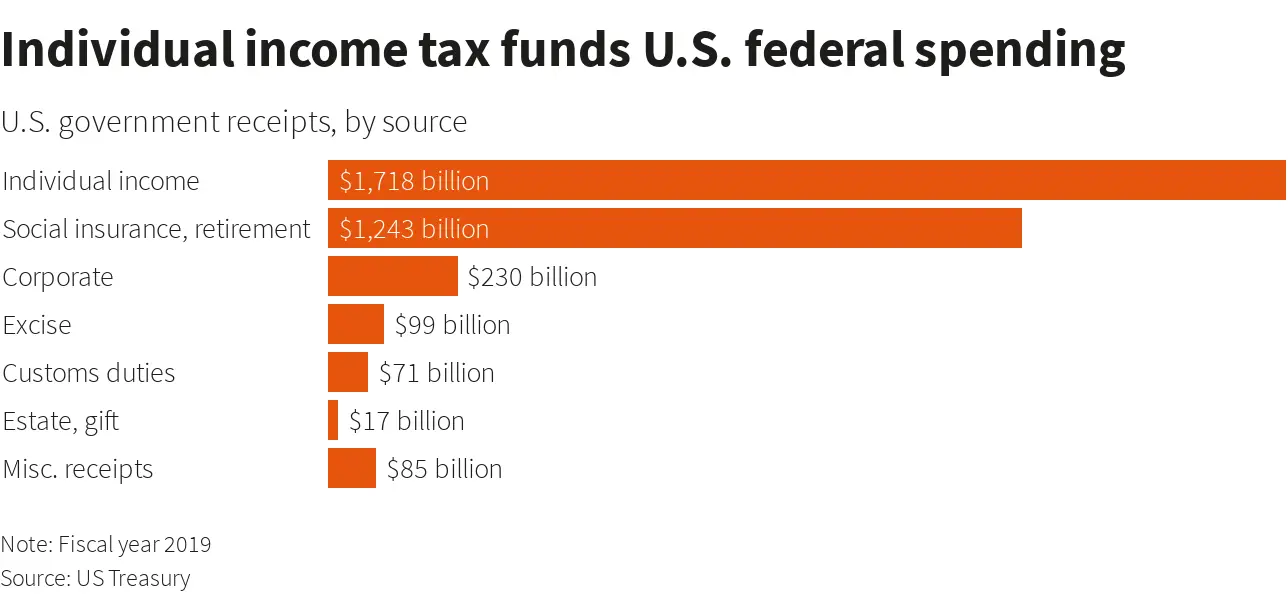

A 2019 Reuters article explained that the majority of US taxes come from the individual taxpayer. Corporations pay little to nothing in taxes.

For example, in 2019, corporations only paid $230 billion in taxes. The rest came from individual taxpayers.

The federal reserve adds trillions of dollars into the economy each year. As a result, inflation increased steadily.

Here is a chart of the inflation of USD for the last ten years.

| Year | USD inflation rate |

|---|---|

| 2021 | 2.24% |

| 2020 | 0.62% |

| 2019 | 1.81% |

| 2018 | 2.44% |

| 2017 | 2.14% |

| 2016 | 1.26% |

| 2015 | 0.12% |

| 2014 | 1.62% |

| 2013 | 1.47% |

| 2012 | 2.07% |

| 2011 | 3.14% |

| 2010 | 1.64% |

Source: https://www.statista.com/statistics/244983/projected-inflation-rate-in-the-united-states/

Inflation is nothing but negative interest on your money. However, this negative interest eats away your savings regardless of whether you save money in a bank account or your home.

When a private business makes terrible decisions, it goes bankrupt. Sometimes, to survive, they layoff people. However, there’s no consequence for the government for making bad decisions, nor do they go bankrupt. A business shrinks during hardship, but a government becomes more bloated during a crisis.

For these reasons, millions of people are unhappy with our government. Therefore, they seek to become independent of government control. They want a separate monetary system that is outside of government control. It is where Bitcoin comes into play.

Side Note: In 1933, the US government made it illegal to own Gold. They forced everyone to sell their Gold to the US government. In 1971, however, this law was repealed.

There was a time gold had two use cases: Currency and Commodity. As Gold is rare, its price has historically been increasing every year. So, many people also hoard a lot of Gold in the hope that they can profit off of it in the future. But, using physical Gold as a currency is clunky. Thus, paper currency replaced Gold currency.

Up until 1971, there was a limitation on how much money the treasury could print. After the removal of Gold standards, however, there’s no more limitation.

In order to save your hard-earned money from negative interest rates (inflation), you have to invest it.

Bitcoin is considered digital Gold. There will be a maximum of 21 million Bitcoin. It’s secure, decentralized, free from government influence, and can be used for online payment. It’s a deflationary currency compared to USD. Therefore, various companies and wealthy people choose Bitcoin as a store of value and investment vehicle. Even Elon Musk considers Bitcoin superior to fiat currency.

Bitcoin is the perfect crypto for borderless anonymous transactions. No other crypto other than Bitcoin is widely accepted.

Because of the limited supply, online use cases, and wide acceptance, Bitcoin is better than the US dollar.

In the last 100 years, we have seen that the stock market has outperformed Gold in several orders of magnitude. In the previous ten years, Bitcoin outperformed both Gold and S&P 500. Therefore, Bitcoin is far superior to USD both as a currency and as an investment vehicle.

We also want to point out that Tether and other Cryptocurrency that claim to be stable coins and backed by either US dollars or Gold are not actually backed by US dollars or Gold in reality.

Tether Limited, the Tether (USDT) issuer, no longer buys USD to back this cryptocurrency. They went full US government. They started the project claiming each Tether token is backed by one US dollar. Later they changed the rules, which now allows them to create coins without US dollar purchase. So, they are not any different from other altcoins.

In short, no currency is backed by anything, whether it is USD, Bitcoin, Ethereum, or Dogecoin. Every one of these currencies has value because we believe these have values.

Moreover, take every altcoin claim with a grain of salt if they say they are backed by something such as USD, Gold, or Silver. There is no government oversight, rules, or anything over cryptocurrencies. There’s no governing body to ensure that these stable cryptos buy Gold or Silver to issue more coins.

In conclusion, though Bitcoin is not backed by Gold or Silver, it’s no different from other fiat currencies.