Elon Musk, the founder of Zip2, PayPal, Tesla, SpaceX, Neuralink, and Boring Company, has only one publicly-traded company — Tesla. All of his other companies are private, including SpaceX.

During an interview in 2018, SpaceX president Gwynne Shotwell said that SpaceX is profitable for a long time. [1]

Therefore, if SpaceX is profitable, then why is SpaceX not a publicly-traded company?

SpaceX is not a publicly-traded company because Elon Musk, who holds a 54% share of the company and 78% voting power, does not want to take SpaceX public until it reaches predictable profitability. Moreover, Elon said, SpaceX will go public only when its rocket Starship can regularly ferry humans to and from Mars.

Let’s elaborate.

In a 2013 tweet, Elon Musk said that “No near term plans to IPO SpaceX. Only possible in the very long term when Mars Colonial Transporter is flying regularly.” [2]

But this is not the sole reason.

Elon Musk’s Tesla went public in 2010.[3] But over the decades, Tesla was the target of vicious short sellers. Criticism of Elon Musk and Tesla was on the front page of every news outlet until 2020.

Over many years, Tesla was the most shorted stock on the stock market. Everyone was betting against Tesla to fail and they were on the verge of bankruptcy in 2018 during the Model 3 production ramp-up.

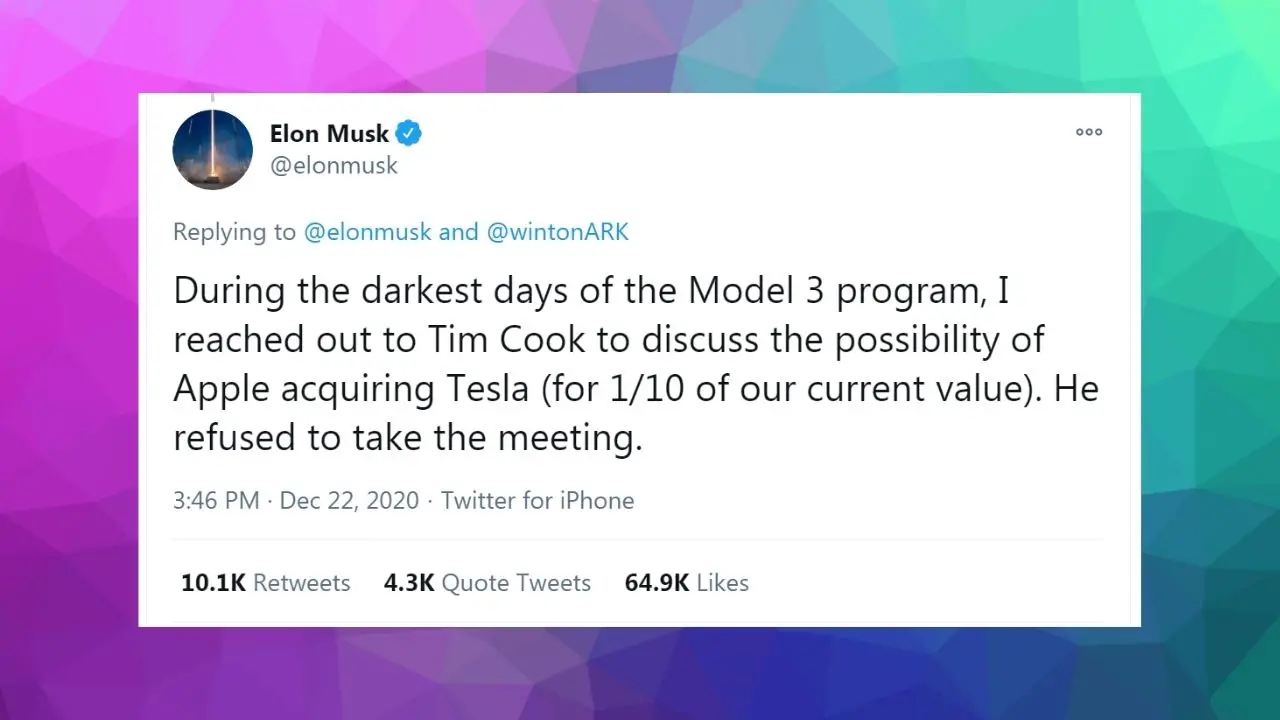

Even Tim Cook, the CEO of Apple, refused to meet Elon Musk to help Tesla during that time.

In 2020, Elon Musk said, “During the darkest days of the Model 3 program, I reached out to Tim Cook to discuss the possibility of Apple acquiring Tesla (for 1/10 of our current value). He refused to take the meeting.” [4]

Over the decade, Elon Musk learned that the stock market does not like a volatile company. Tesla is developing many new technologies in the electric vehicle segment. They are the leader only because of Tesla’s decade’s long research and development and technological prowess.

The stock market does not like this kind of unpredictability. Each quarter, a publicly-traded company such as Tesla needs to report to shareholders its earnings, how many cars they sold, how much they made revenue and profit, etc.

Because of this short term focus on companies, many analysts fail to see the upside of long term growth as many fail to see Tesla’s growth potential.

In 2018, Elon Musk and Tesla were getting constant negative press; that’s why he even tried to take Tesla private. If a company is not profitable and overgrowing while burning money, it should not go public. Elon Musk learned that hard way.

Since Tesla went public, Elon often said that he would not take SpaceX public until it reaches predictable profitability.

SpaceX Innovation:

SpaceX is transforming the rocket industry. Before SpaceX, everyone said that landing an orbital class rocket is impossible. However, SpaceX proved that it not only possible; they did it more than 100 times.

When Elon Musk announced that SpaceX and NASA in partnership would take humans to and from the International Space Station (ISS), everyone opposed it, including “Neil Armstrong.” [5]

But now, SpaceX is the first private company in history to send humans to ISS.

Rocket engineering is hard. It needs innovation on many fronts. SpaceX will not see the fruits of its labor until the next 5 to 10 years. But sometimes, the stock market becomes irrational and puts pressure on companies needlessly. These pressures make CEOs look into short term company goals and abandon long term plans.

Elon Musk said, “Mars requires developing complex technology over a decade+, but market cares about next 3 months. Result would be conflicting priorities.” [6]

Therefore, Elon believes that making SpaceX public will stifle innovation.

So, when will SpaceX go public?

SpaceX is currently developing a fully reusable rocket, Starship. In a 2020 interview at “International Mars Society Convention,” Elon Musk said SpaceX targets 2024 for a Mars launch with this rocket. [7]

Initially, all the Starship launches will be uncrewed. Once it reaches significant reliability without any issues, it will send humans to Mars. But this is not going to happen until 2026. Therefore, SpaceX will not go public before 2026.

In 2013, Elon Musk sent an email to all of his SpaceX employees regarding SpaceX going public. Ashlee Vance included that email in the book, “Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future.“

Here’s the email:

From: Elon Musk

Date: June 7, 2013, 12:43:06 AM PDT

To: All <All@spacex.com>

Subject: Going Public

Per my recent comments, I am increasingly concerned about SpaceX going public before the Mars transport system is in place. Creating the technology needed to establish life on Mars is and always has been the fundamental goal of SpaceX. If being a public company diminishes that likelihood, then we should not do so until Mars is secure. This is something that I am open to reconsidering, but, given my experiences with Tesla and SolarCity, I am hesitant to foist being public on SpaceX, especially given the long term nature of our mission.

Public company experience may think that being public is desirable. This is not so. Public company stocks, particularly if big step changes in technology are involved, go through extreme volatility, both for reasons of internal execution and for reasons that have nothing to do with anything except the economy. This causes people to be distracted by the manic-depressive nature of the stock instead of creating great products.

It is important to emphasize that Tesla and SolarCity are public because they didn’t have any choice. Their private capital structure was becoming unwieldy and they needed to raise a lot of equity capital. SolarCity also needed to raise a huge amount of debt at the lowest possible interest rate to fund solar leases. The banks who provide that debt wanted SolarCity to have the additional and painful scrutiny that comes with being public. Those rules, referred to as Sarbanes-Oxley, essentially result in a tax being levied on company execution by requiring detailed reporting right down to how your meal is expensed during travel and you can be penalized even for minor mistakes.

SpaceX President Gwynne Shotwell reconfirmed it to CNBC in the 2018 interview. She said, “we can’t go public until we’re flying regularly to Mars.” [10]

Interesting Findings:

Why are SpaceX rockets cheaper?

A United Launch Alliance rocket costs around $400 million per launch, whereas a SpaceX Falcon 9 rocket costs only $60 million and the SpaceX Falcon Heavy rocket costs $90 million.[8] So, why are SpaceX rockets cheaper? To learn more, click here.

Elon Musk SpaceX Ownership:

SpaceX is a privately held company, and Elon Musk is the principal shareholder of SpaceX. During a recent FCC filing, SpaceX revealed that Elon Musk owns 54% of the company with 78% voting control in the SpaceX board.[9] Moreover, Elon Musk is the only person who owns more than 10% share of this company.

Elon Musk has 3 citizenship:

Do you know Elon Musk holds 3 citizenship? These are South African, Canadian, and American citizenship. To learn more click here.

The Bottom Line:

Elon Musk and SpaceX have a long term goal. Investors in the stock market only care about short-term investment returns. If a company has a long term goal and has no short term profit target, its stock would get crushed in the stock market. That’s why Elon needs to keep SpaceX private so that he can achieve his Mars mission.